Kontaktieren Sie uns gerne bei allen Fragen rund um den Kauf von Immobilien.

Tel.: 089 340 823-540 | verkauf@mrlodge.de

Jacqueline Sauren

Head of Real Estate Sales

![[Translate to english:] Das ideale Objekt [Translate to english:] Beispielwohnung](/fileadmin/_processed_/4/2/csm_Das_ideale_Objekt_f4760e1da7.jpg)

Find out on this page how property prices in Munich are changing, which districts are currently the most sought-after in Munich, how Mr. Lodge determines property values in the current market situation, what rents and purchase prices can be achieved and why we can competently support you in this endeavor.

Munich has grown strongly in recent years. As the third-largest metropolis in Germany, the city of over 1.5 million inhabitants is in high demand as a place to work and live.

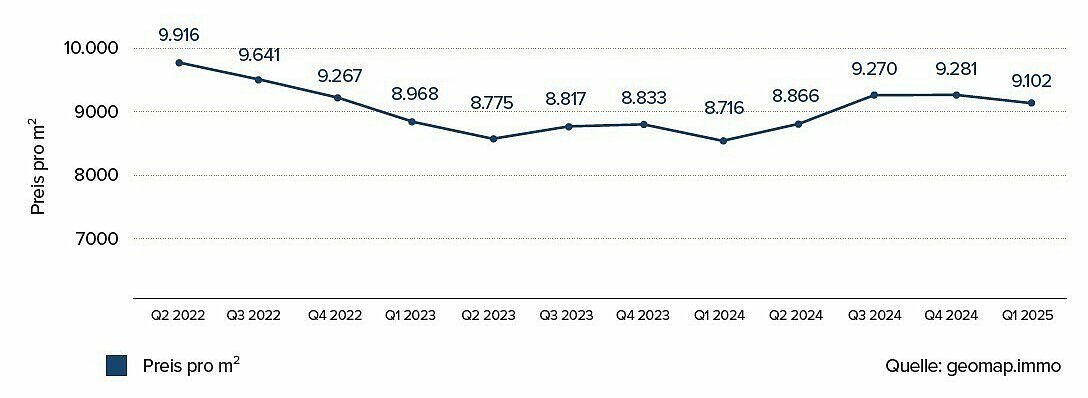

At the beginning of 2026, the real estate market in Munich is in a generally stabilized state. Following the significant corrections of previous years and the temporary fall in purchase prices, the market has consolidated noticeably. Current supply data for Munich shows an average value of around €8,165/m² for condominiums in February 2026 and around €9,214/m² for houses. This suggests that the recovery will continue at a high level - without a return to the extreme dynamics of the boom years. At the same time, location, property quality and realistic prices remain decisive for sales success.

Anyone selling a property in Munich needs an experienced market professional to determine a fair market price. Now that prices per square meter have risen over a long period of time and the market has developed in a much more differentiated way since 2022, pricing today requires special care.

The experienced real estate consultants at Mr. Lodge develop a sensible, individual sales strategy. When determining the right property price, they also take into account what buyers in Munich can currently afford, the financing situation and the target group in which the property on offer has the best chances of selling. Especially in a market where good properties are still in high demand, but buyers are also more selective, a precise valuation is more important than ever.

Real estate prices in Munich have been at a very high level for years. If you look at purchase prices for condominiums, there is still a clear upward trend over the long term - despite the correction phase of recent years.

At the beginning of the 2010s, prices per square meter for condominiums in Munich were still at a significantly lower level. In the years up to 2021/2022, there was then - depending on the data basis and segment - a massive price increase to regions of around €9,000 to €9,500/m². This corresponds to a near tripling of prices in many market segments within around ten years.

This steep price increase reached its temporary peak in 2021/2022. After that, prices per square meter in Munich initially fell. In particular, the rise in interest rates, higher financing costs and a change in buyer psychology led to a noticeable price correction in 2022 and especially in 2023. However, stabilization has been observed again since 2024. The more recent data sets show slight increases in asking prices for condominiums again for 2024 and 2025; this trend continues moderately at the beginning of 2026.

Development of asking prices for condominiums in Munich from 2012 to the 1st quarter of 2025 (in euros per square meter)

Abb. 1: Durchschnittliche Angebotspreise für Eigentumswohnungen in München (Euro pro m²). Seit 2012 sind die Preise stark gestiegen – von rund 4.000 €/m² im Jahr 2012 auf etwa 9.500 €/m² zum Höchststand 2022

Die Grafik verdeutlicht den langfristigen Aufwärtstrend und jüngste Veränderungen. Zwischen 2012 und 2019 legten die durchschnittlichen Angebotspreise Münchner Wohnungen jährlich zweistellig zu. Im 1.Quartal 2013 lag der Quadratmeterpreis bereits bei ca. 5.027 € (+15 % zum Vorjahr). Bis 2015 verdoppelten sich die Preise gegenüber 2010 (+85 % auf ~5.750 €/m²). In den folgenden Jahren setzte sich der Anstieg fort und erreichte Anfang 2022 einen vorläufigen Höhepunkt um ~9.500 €/m². Seitdem kam es infolge gestiegener Zinsen zu einer Preiskorrektur: Bis Ende 2023 sanken die Angebotspreise auf etwa 7.550–7.700 €/m². Aktuell ist jedoch wieder eine Stabilisierung erkennbar – im 1. Quartal 2025 liegt der Durchschnittspreis bei ca. 8.200–8.300 € pro m². Somit stehen die Preise trotz des Rückgangs weiterhin deutlich über dem Niveau von 2012.

The prices per square meter in Munich are often used by buyers and owners as a reference value for property valuation. However, the average values from the Munich districts cannot be used to determine with certainty how much a specific property actually costs. This requires the experience of a long-standing market expert like Mr. Lodge, because apartments and houses are very individual and a number of value-determining factors must be taken into account.

Nevertheless, trends can be identified in Munich that influence prices per square meter. Despite the correction phase of recent years, Munich remains one of the most expensive real estate locations in Germany. Current market data - depending on the source and calculation method - continues to show high average or median values for apartments. While listing data portals currently show around €8,165/m² for condominiums and around €9,214/m² for houses, other market models (e.g. median values from large data pools) also show some apartments at around €9,179/m². These differences underline the importance of classifying the data source.

For potential buyers, the average price per square meter for existing properties in Munich 2026 - depending on location and segment - is often in the range of around €8,000 to €8,500 per m². In sought-after districts such as Altstadt-Lehel, Maxvorstadt and Schwabing, prices in good to very good locations remain significantly higher and can still be well above €10,000/sqm for high-quality properties . Significantly higher values are also possible in top segments. At the same time, lower entry-level prices can still be realized in peripheral districts such as Aubing-Lochhausen-Langwied, Trudering-Riem or parts of Pasing-Umfeld. The range in 2026 will therefore remain wide and highly location-dependent.

For buyers, the market phase after the correction of 2022/2023 continues to offer opportunities. Anyone buying in 2026 will find offers in many places that - depending on the segment and location - are still below the highs of the boom years. At the same time, the negotiating position is not equally strong in every segment: well-designed, energy-efficient and attractively located properties will remain highly competitive. However, those who can secure solid financing and calculate realistically will continue to find interesting entry options on the Munich real estate market in 2026.

Owners in Munich can continue to benefit from high prices per square meter in 2026. Average prices in central locations will remain at a very attractive level, enabling good sales values in prime locations. In districts such as Laim, Moosach or Sendling, the achievable price depends even more on the micro-location, condition, year of construction, floor plan quality and energy quality of the property - and can vary considerably depending on the property.

For owners, 2026 is an interesting year to examine sales opportunities: The market is no longer characterized by the uncertainty of the strongest correction phase, while at the same time buyers are paying more attention to value for money and property quality. A thorough market analysis is therefore advisable in order to set realistic price targets, activate demand optimally and avoid unnecessary marketing times. Attractive sales results can still be achieved, particularly for high-quality properties or properties that are very easy to let.

Wer in München ein Haus oder eine Wohnung verkaufen möchte, profitiert von der Entwicklung der Münchner Immobilienpreise. Die beliebtesten Stadtteile liegen vor allem rund um den Stadtkern bzw. die Münchner Altstadt. Dort finden sich Ausgehmöglichkeiten jeglicher Couleur und kulinarische Angebote für jeden Geschmack.

Die Stadt München lebt und ist immer nah am Puls der Zeit – das merkt man vor allem in den Vierteln nahe dem historischen Zentrum. Dennoch gibt es auch weitere lukrative Bezirke in und um München. Auch wenn Orte wie Germering, Unterhaching und Unterföhring bei Studenten nicht ganz oben auf der Beliebtheitsskala stehen, wohnen Familien oder ältere Semester gerne in diesen etwas ruhigeren Gefilden im Umland.

Selbstverständlich schlägt sich die Nachfrage auch auf die Quadratmeterpreise nieder: Je beliebter das Viertel, desto höher die Kaufpreise. Da sich Münchner Immobilienpreise seit 1950 auf Rekordniveau bewegen und München diesbezüglich zu den teuersten Städten Deutschlands zählt, sind Immobilien in allen Bezirken stark gefragt.

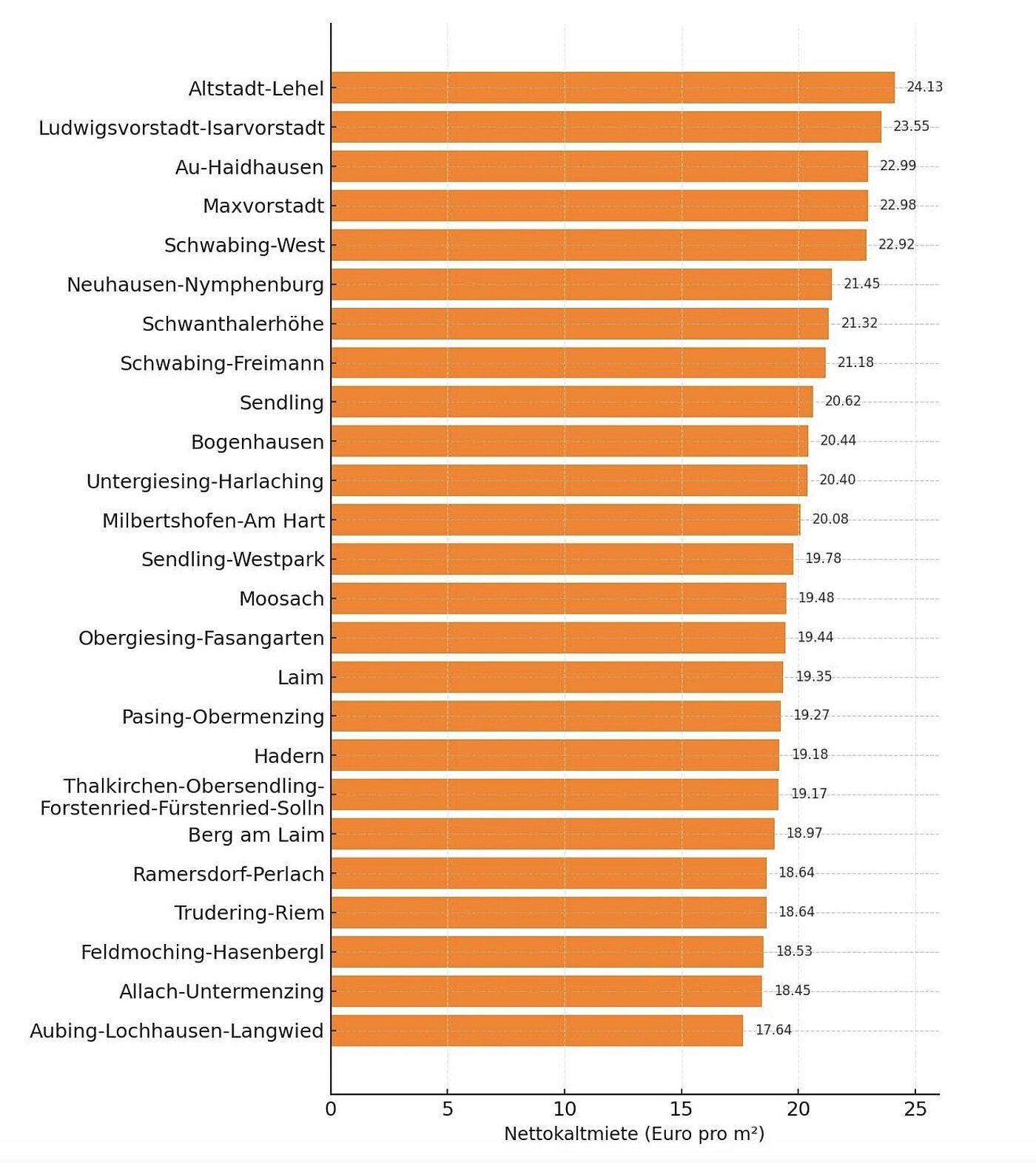

Geht man nach den Mietpreisen Anfang 2025 für Wohnungen, stehen insbesondere diese fünf Stadtteile an der Spitze: Altstadt-Lehel, Maxvorstadt, Ludwigsvorstadt-Isarvorstadt, Schwabing (mit Schwabing-West) und Au-Haidhausen. In all diesen Bezirken sind pro Quadratmeter Nettokaltmieten von rund 26 bis 27€ einzuplanen.

Mietpreise für Wohnungen in München im Jahr 2024, unterteilt nach Bezirken (in Euro pro Quadratmeter)

Quelle: ChatGPT / Mr. Lodge – Angebotsmieten München nach Bezirken 2025

Abb. 2: Durchschnittliche Wohnungsmieten (Netto-Kalt) nach Münchner Stadtbezirken – Q3 2025 (Euro pro m²).

Die teuersten Stadtteile liegen inzwischen bei 26–27 €/m², während in peripheren Bezirken ca. 20–21 €/m² üblich sind.

Auch die Mietpreise variieren deutlich je nach Lage. Im Stadtmittel beträgt die Angebotsmiete für Wohnungen aktuell rund 20,5 € pro m². Spitzenreiter ist der zentrale Bezirk Altstadt‑Lehel, wo Angebotspreise teils 26–27 € pro m² betragen, gefolgt von Maxvorstadt, Au‑Haidhausen und Schwabing‑West in ähnlichen Preisregionen (je ca. 27–29 €/m²) . Im Gegensatz dazu sind die peripheren Bezirke deutlich günstiger: In Aubing‑Lochhausen‑Langwied liegt die Miete bei etwa 20–21 €/m², ebenso in Allach‑Untermenzing und Feldmoching‑Hasenbergl. Insgesamt zeigt die Mietpreisspanne — von unter 21 € bis über 27 € pro Quadratmeter — die hohe Lageabhängigkeit der Wohnkosten in München.

Quellen: Marktberichte und Preisdaten von Statista, Immowelt/ImmoScout24 und IVD. Alle Werte beziehen sich auf Angebotsdaten (Inseratsdurchschnitt).

As financing costs continue to rise, many prospective property buyers can only afford to buy their own home or condominium to a limited extent. The financial strength of potential buyers has become more selective and therefore the decision-making period has become longer, although the basic demand in Munich remains high. Accordingly, the diligence of a market expert with many years of experience, such as Mr. Lodge, is important for determining a sales price in line with the market.

In 2026, the residential real estate market as a whole is in a phase of recovery and reorganization. Compared to the peak phase of market uncertainty, the situation has improved significantly. At the same time, the market picture is more differentiated: supply has increased in some segments, while particularly attractive properties remain scarce and in high demand. Thanks to slightly better planning certainty for financing and a more stable price environment, we expect buyer interest on the Munich market to remain solid in 2026. Furnished apartments and houses remain attractive investment opportunities, especially in sought-after locations. This means that the current situation remains favorable for many property owners who want to sell their property - whether owner-occupied or rented - provided that the pricing approach and marketing strategy are chosen professionally.

Mit Mr. Lodge als Partner an Ihrer Seite steht dem erfolgreichen Verkauf Ihrer Immobilie nichts mehr im Wege. Seit über 30 Jahren sind wir in München und Umland als Makler tätig und kennen den Markt in- und auswendig.

Wenn es um den Verkauf Ihrer Immobilie geht, handeln wir routiniert und professionell. Wir gehen dabei wie folgt vor:

Für die Erstellung eines Exposés Ihrer Immobilie werden von unserem hauseigenen Fotografenteam Bilder und Videos von Ihrer Wohnung oder Ihrem Haus angefertigt und die Kerndaten der Immobilie zusammenfasst. Dieses veröffentlichen wir einmal auf unserer Homepage und einmal auf den allseits bekannten Internetportalen.

Im nächsten Schritt machen wir uns Gedanken über die Adressaten Ihres Verkaufes: Ist es eher das junge Paar mit Kindern, der Student, dessen Eltern sich die Wohnung für ihr Kind leisten oder sind es eher ältere Menschen, die als Kaufinteressent der Immobilie in Frage kommen?

Je nach Zielgruppe überlegen wir uns im Team eine passende Marketingstrategie. Nicht jeder Kanal eignet sich für alle Interessenten. Während junge Leute immer mobil sind und täglich Plattformen wie TikTok oder Instagram nutzen, sieht dies beim älteren Semester ganz anders aus. Immobilieninteressenten eines bestimmten Alters nutzen Immobilienportale oder auch Anzeigen etablierter Printmedien, um das Haus oder die Wohnung Ihrer Träume zu finden. Es gibt zig Möglichkeiten und es gilt, die Potenziale bestmöglich zu nutzen.

Um ideale Interessenten für Ihre Immobilie zu finden, verfassen wir proaktiv Mailings für eine direkte Kundenansprache. Als weitere Kommunikationsmaßnahmen werden Printmedien und Aushänge in unseren Schaufenstern in München und Rottach-Egern genutzt, um Aufmerksamkeit zu generieren. Potenzielle Käufer werden gezielt von uns angesprochen und zusätzliche Interessenten proaktiv gesucht. Für Sie als Verkäufer bedeutet dies, dass Sie fortlaufend über den Stand der Vermarktung informiert werden. Auch der Fortgang der Verhandlungen und die nächsten Schritte im Verkaufsprozess werden mit Ihnen als Eigentümer besprochen und anschließend umgesetzt.

Im Anschluss führen wir mit ernsthaft am Kauf Interessierten mit Ihnen persönlich oder in Ihrem Namen Besichtigungstermine durch. Selbstverständlich werden Mieterinnen und Mieter und auch Sie als Immobilienbesitzer informativ in diesen Prozess eingebunden. Wir arbeiten hier immer Hand in Hand.

Weiterhin sind wir kompetenter Ansprechpartner, wenn es um das Thema Verkaufsverhandlungen und Konditionen geht. Begleitend unterstützen wir potenzielle Käuferinnen und Käufer bei der Aufnahme der Hypothek.

Zu guter Letzt wird der notarielle Kaufvertrag nach unseren Vorgaben von einem Notar aufgesetzt. Wir besprechen diesen vorab mit Ihnen als Eigentümer und begleiten Sie am Ende auch zum Notartermin, wo der Immobilienverkauf durch die Unterschrift aller Beteiligten besiegelt wird.

Als lokaler Makler sind wir Experten auf dem Münchner Immobilienmarkt. Wir besitzen ein großes Netzwerk und analysieren täglich die Marktentwicklung. Wir wissen, welche Immobilienart und welche Stadtteile gerade gefragt sind und beraten Sie professionell bei der Preisverhandlung mit Kaufinteressenten.

Mit jahrelanger Expertise und einem sehr professionellen wie mehrsprachigen Team verfügen wir über reichhaltige Erfahrung - auch bei internationalen Käufern.

Wir verstehen den Markt und können für Sie den optimalen Verkaufspreis erzielen. Hierbei übernehmen wir alle Aufgaben für Sie, um den Erfolg Ihres Immobilienverkaufs sicherzustellen.

Property prices in Munich are expected to remain at a high level in 2027. Following the significant correction phase and subsequent stabilization in the years 2024 to 2026, a widespread fall in prices is currently rather unlikely. A differentiated development is more likely: Prices could increase moderately in particularly sought-after locations, while they are more likely to remain stable or fluctuate only slightly in peripheral locations or for less attractive properties.

A continued moderate interest rate level in the area in which financing for owner-occupiers generally remains feasible is unlikely to trigger extreme price momentum, but may support demand. In sought-after districts such as Schwabing, Altstadt-Lehel and Maxvorstadt, this could lead to slight price increases, while in less central locations such as Aubing or parts of Moosach, a sideways movement is more likely. For 2027, many factors point to a stable to slightly positive market trend - provided that the macroeconomic environment remains free of major shocks. This assessment is a continuation of the market recovery observed in 2025/2026 and the moderate upward trend expected nationwide.

In 2027,buyers will probably still have the opportunity to acquire properties at more rational conditions than in the boom years before 2022. Particularly in less central locations or for properties in need of renovation, there could be more moderate prices and scope for negotiation, which could enable an attractive market entry. In prime locations, on the other hand, potential buyers should continue to expect high competition and stable to slightly rising prices, as sought-after properties will remain in short supply there.

Owners in Munich can expect prices to remain at a high level overall in 2027. In sought-after locations, there is still an opportunity to achieve attractive sales prices. In peripheral districts or for properties in need of modernization, the achievable price is likely to depend more on professional marketing and a realistic pricing strategy. For owners in peripheral locations, an early market analysis can therefore be particularly useful in order to determine the best time to sell and the optimum asking price.

Conclusion: The Munich real estate market is expected to continue its recovery at a high level in 2027. Buyers will benefit from a more predictable market environment than in the boom years, while sellers - especially in prime locations - will still be able to achieve very good prices. However, close monitoring of market trends and professional valuation remain essential in order to operate successfully in this challenging market.

You may also be interested in these topics:

Kontaktieren Sie uns gerne bei allen Fragen rund um den Kauf von Immobilien.

Tel.: 089 340 823-540 | verkauf@mrlodge.de

Jacqueline Sauren

Head of Real Estate Sales